GST Registration Services

Get your GST registration done accurately and on time with CA-led assistance from eligibility check and documentation to approval and post-registration guidance.

What is GST Registration?

GST Registration is the process by which a business is registered under the Goods and Services Tax (GST) regime and receives a unique GST Identification Number (GSTIN). It is mandatory for businesses whose turnover exceeds the prescribed threshold or those engaged in inter-state supply, e-commerce, or notified categories of services.

Which businesses need GST Registration?

GST Registration is mandatory for businesses that meet certain turnover limits or fall under specified categories as per the GST law.

Businesses Required to Register Based on Turnover

GST registration becomes mandatory once a business crosses the prescribed annual turnover limit. These limits vary depending on whether the business is located in a Normal Category State or a Special Category State.

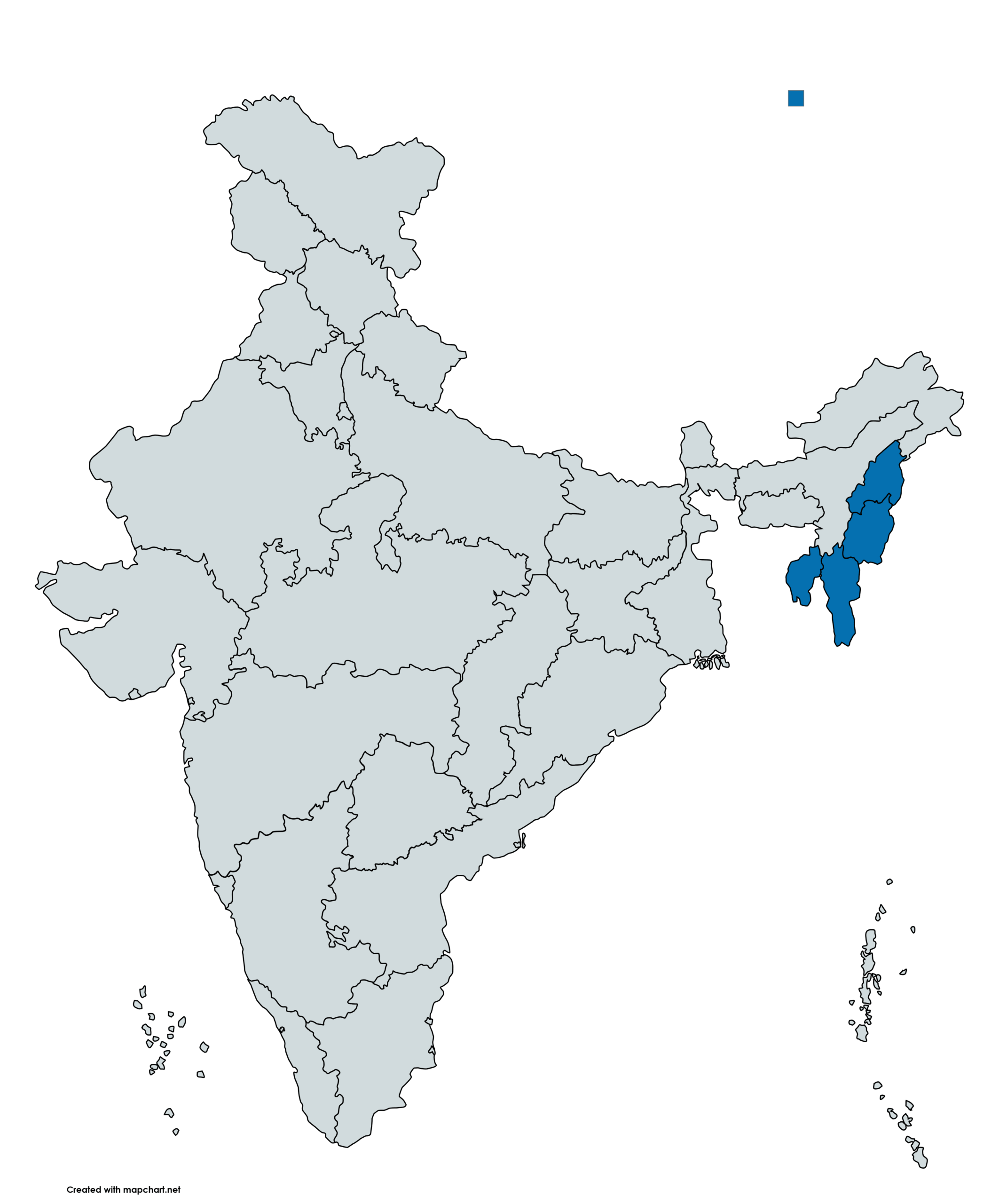

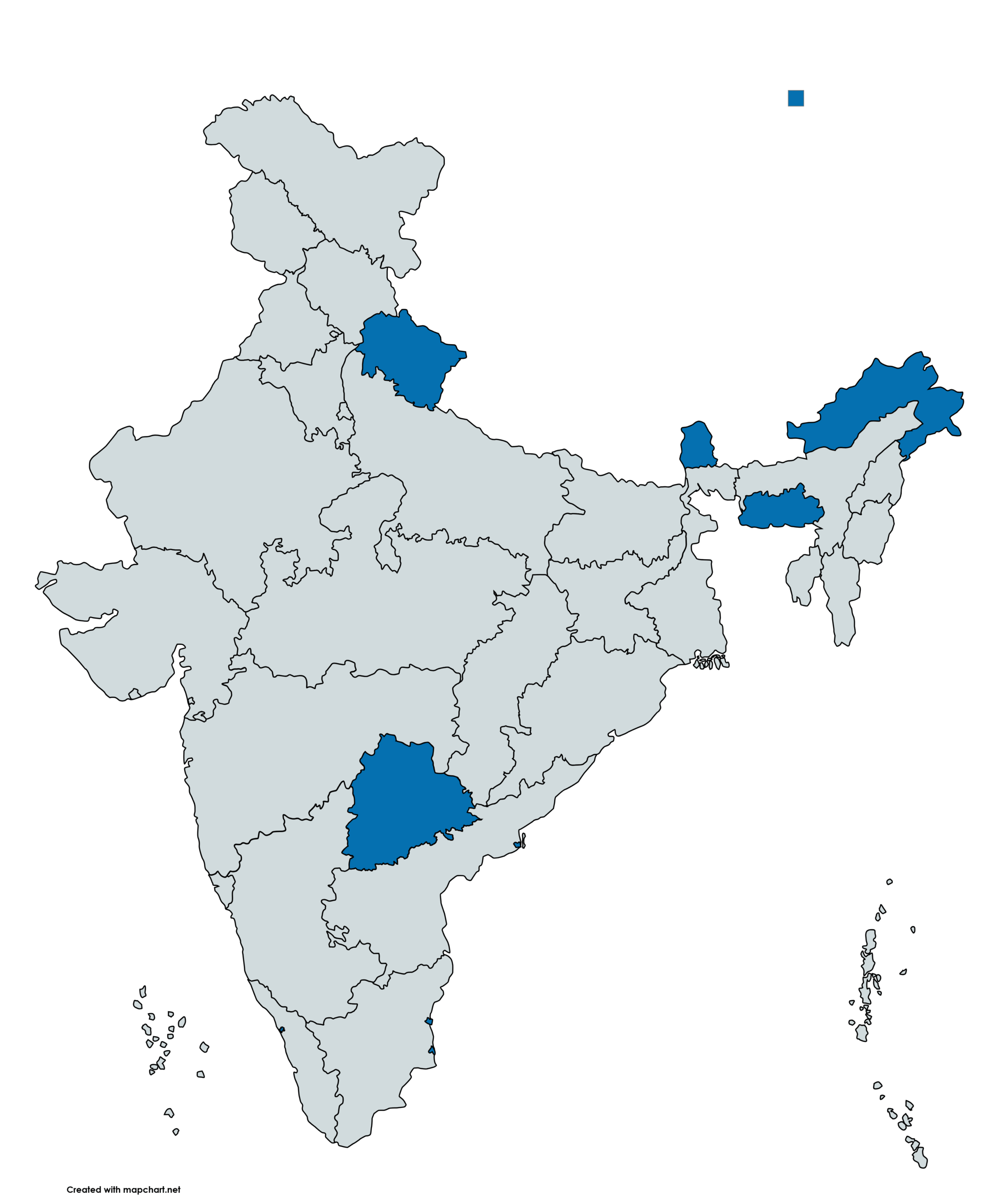

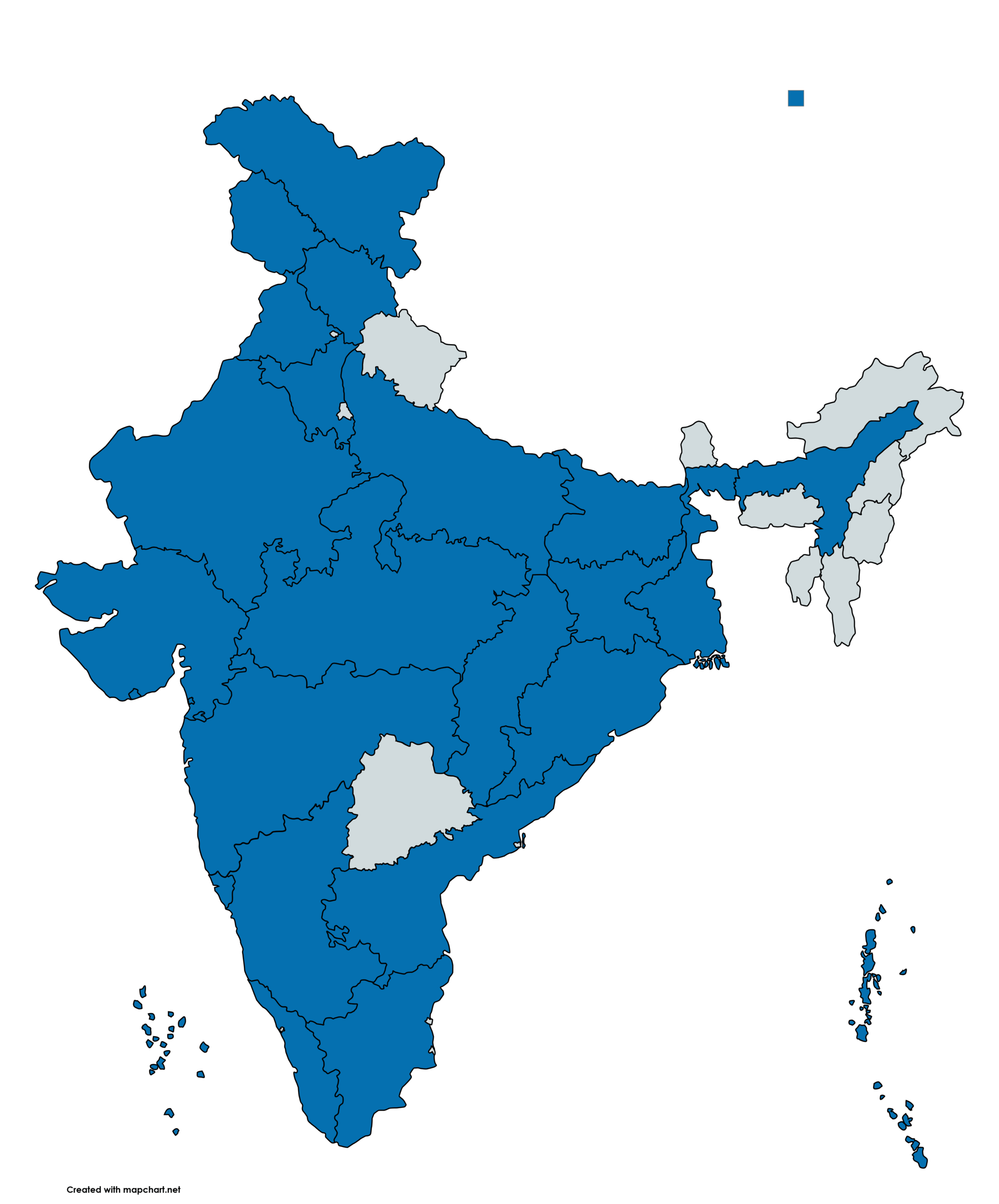

| MAP | STATES/ UNION TERRITORIES | DEALS ONLY IN GOODS | DEALS ONLY IN SERVICES | DEALS IN BOTH GOODS & SERVICES |

| – Manipur – Mizoram – Nagaland – Tripura | ₹ 10 Lakhs | ₹ 10 Lakhs | ₹ 10 Lakhs |

| – Arunachal Pradesh – Meghalaya – Puducherry – Sikkim – Telangana – Uttrakhand | ₹ 20 Lakhs | ₹ 20 Lakhs | ₹ 20 Lakhs |

| All other States and Union Territories | ₹ 40 Lakhs | ₹ 20 Lakhs | ₹ 20 Lakhs |

Businesses Required to Register Irrespective of Turnover Limit

Note

Failure to obtain mandatory GST registration can result in penalties, interest, and denial of input tax credit under the CGST Act 2017.

Mistakes to avoid in GST Registration

How we support in GST Registration?

Comprehensive GST Registration solutions handled by experienced Chartered Accountants.

CA-Led Compliance

Entire registration process is prepared and reviewed by qualified Chartered Accountants, ensuring professional-grade accuracy.

Accuracy Guarantee

Our multi-level verification process ensures error-free registration, protecting you from notices and penalties.

Timely Reminders

Proactive deadline tracking and reminders ensure you never miss a due date. On-time, every time.

Dedicated Support

A dedicated compliance manager for all your queries, notices, and year-round TDS support needs.

Get Transparent Pricing for GST Registration

No hidden charges. Clear pricing based on your needs.

-

Is GST registration mandatory for service providers and freelancers?

GST registration is mandatory for service providers and freelancers if:

(a) Aggregate annual turnover exceeds ₹20 lakhs (₹10 lakhs in Special Category States).

(b) If they provide inter-state services, work with e-commerce platforms, or fall under notified categories. -

How long does it take to get GST registration approved?

GST registration is generally approved within 7–10 working days, provided all documents are correct and Aadhaar authentication is completed. If clarification is sought by the department, the timeline may extend.

-

Can I take GST registration voluntarily even if it’s not mandatory?

Yes, a business can opt for voluntary GST registration but it is not advisable.

-

Can one PAN have multiple GST registrations?

Yes, a single PAN can have multiple GST registrations if the business operates in more than one state. Each state requires a separate GST registration, while compliance is tracked PAN-wise.

-

Do I need a CA for GST registration?

GST registration is completed online through the GST portal, and many businesses choose to take professional support from a Chartered Accountant to ensure accuracy and compliance.

Still got some questions?

Speak with a GST expert and get clarity on your compliance needs.